Change, complexity and economic impacts all provoke the business into some change in their response to the business landscape. A key aid to understanding the response needed is a grounding in business analytics. As part of business analysis, success depends on practical application of three different types of analytics, financial, quantitative and descriptive. These form what is known as the analysis triangle. The three types of analytics in the analysis triangle provide a guideline to successful analysis. To generate a response to the business environment, the business analysis is process and operational focused and hence has an internal focus.

A good way to understand the value of analytics especially those of predictive and diagnostic analytics is to consider the analogy of mining such as mining for diamonds. Searching for diamonds in a diamond bed (assuming you find the diamond bed) may turn up a lot of diamonds. However, not all of them are of high value to the miner and may actually have little value. A diamond specialist sorts out the diamonds into categories according to value in the current market.

Using predictive and diagnostic type analytics is similar to the diamond mining example. Not all predictive and diagnostic analytic results are valuable. Changing an algorithm or parameter for purposes of efficiency may damage the result. These changes are the task of the business user or data analytics expert in the organization. Selecting the sets of data to analyse is also the responsibility of the analyst. This is typically not an IT task however, IT will run the analytics and provide the results to the user.

Business analytics also lead to the development of requirements for process change, application acquisition (application development, package deployment or services articulation) and assessment of change impact the analytics can be used to sort through the maze of options available to the manager. Business analysis and the related analytics also includes topics of operational due diligence, performance measurement, knowledge management, product architecture, process architecture, competitive intelligence and business intelligence.

Analytic techniques are used for support of decisions in business organizations. They determine the response to the business ecosystem in terms of opportunity and threat neutralization. That includes all the major actions, such as: merger, acquisition, divestiture, privatization, consolidation and outsourcing. Analytic methods are important for realizing the results of restructuring efforts.

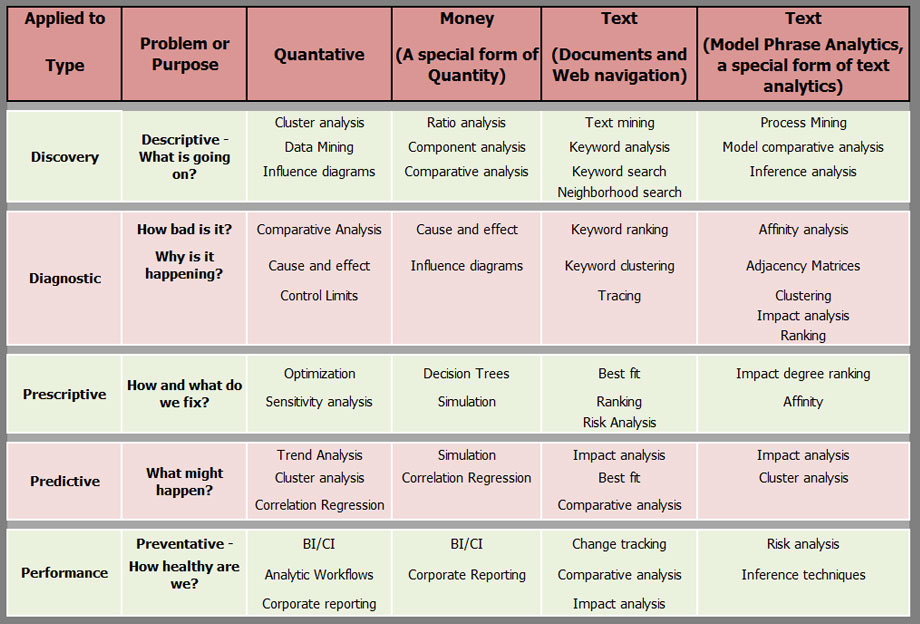

Business analytics are not new, they are a combination of various strategies, techniques, methods, and tools to improve the organization or enterprise's performance. These can become part of the management system and represent the selected approaches used by the organization. The analytic framework below shows techniques best suited to shed light on various business issues:

Various statistical and other techniques are included in the application of the different types of analytics. Business analysts should be familiar with analytic techniques that can be applied to solving problems in an enterprise. While there are many quantitative analytical techniques, several core analytic techniques have proven useful over time in understanding issues that face most executives. These techniques help the manager or executive sort through various options or alternatives and decide on which path to take in directing the organization. These techniques are well known and are applied to basic business problems that are usually well defined or at most poorly defined. Ill-defined problems require different analytic techniques. The techniques include but are not limited to:

- Operational analysis

- Performing ‘What IF’ analysis on alternatives

- Basic cost /benefit analysis

- Productivity analysis in services and manufacturing

- Impact assessment on strategies using strategy maps

- Process analysis to assess yield versus risk in ranking processes

- Decision analysis to select among options

- Influence modeling to describe problems

- Financial analysis to identify key results indicators

Business and other analysts are well advised to have at least a passing knowledge of these techniques and a detailed knowledge in those that apply to their business needs. KCI professional education addresses these needs.

- Analytics Resources

- Analytics Professional Education